Origin unites your finances with our all-in-one platform. Our app helps you budget, actively invest, and grow your savings with up to 5.8% APY (promotional rate). Plus, create a will and get AI-powered financial guidance when you need it.Hey Product Hunt!

I’m Matt Watson, founder of Origin.

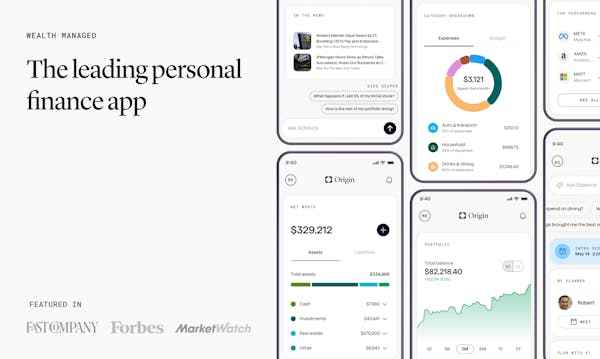

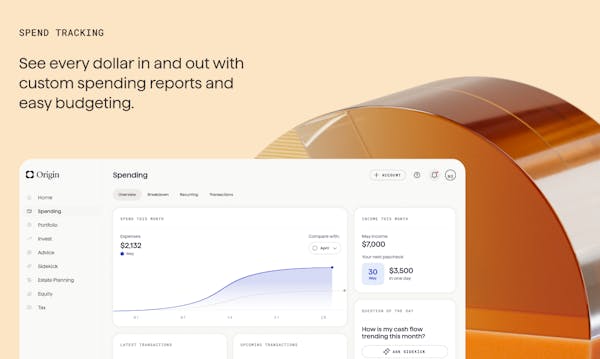

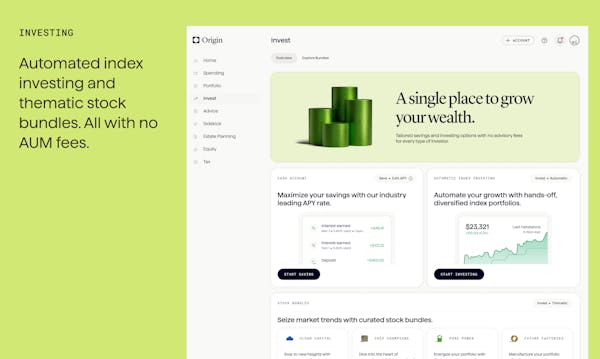

Origin is reimagining wealth management for the next generation. We’re an all-in-one platform, where you can track your spending and budget, actively invest, save, file taxes, and get expert financial guidance.

We’ve come a long way from when we started 5 years ago…

Back then, we launched Origin as a financial wellness benefit. We worked with leading employers to help their employees understand stock options. Equity was a black box. We started building and selling a product that helped employees understand their stock options and learn how to make smart financial decisions around equity. Then, we expanded into spending, net worth, and investment tracking and are now used and loved by employers such as DocuSign, Reddit, and Modern Health. We’re the #1 budgeting app in 2024, ranked by Forbes.

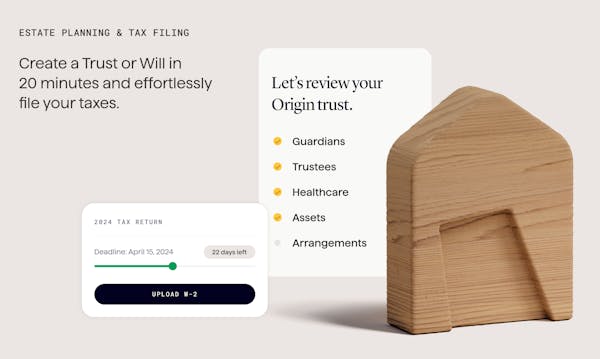

Last year, we took our product direct to consumer. We brought online even more features beyond tracking—including tax filing and estate planning—to become the most comprehensive wealth-building platform.

Today, we’re launching Origin on ProductHunt to celebrate the significant updates we’ve made to our platform and our new features. Here are a few of my favorites:

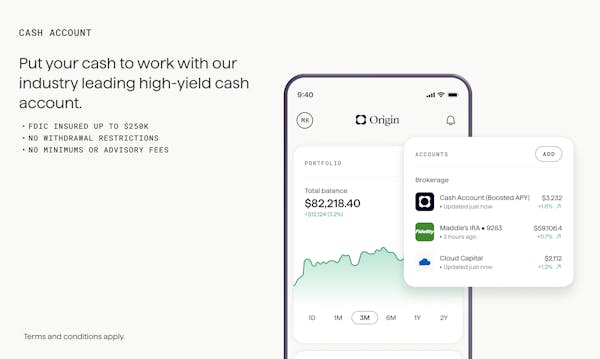

- 5.8% APY* High-Yield Cash Account: Put your money to work with an industry-leading cash account at 5.8% APY* (promotional rate).

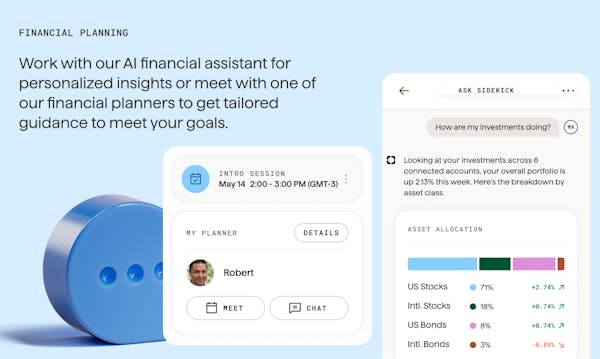

- Intelligent AI-powered Insights: Get smart notifications on your spend velocity, credit score changes, and portfolio movement.

- Improved AI guidance: Get an automated portfolio analysis and plan for retirement with AI-powered guidance.

- Expert-built stock bundles: Invest in line with your interests with stock bundles such as Travel Titans and Cloud Capital.

- Referral program: Invite your friends and family to Origin and earn rewards.

We’re pumped to go live on PH, and we’d love to hear your questions and feedback! Thank you again for your support.

Matt

*See disclaimers here: https://www.useorigin.com/legal@mwatson my congratulations! I really like that Origin seeks to simplify financial management by merging numerous tools and services into a single platform, allowing customers to more easily attain their financial goals.@mwatson so excited for the world to see what we’ve been working onI've been using this product for the past month and have been extremely impressed... I think this is the best product out there for someone who understands their finances. I work in fintech and try nearly every product out there. Most of the products are designed for people with very simple finances - a bank account, an investment account and that's about it. I have very complicated finances and honestly there isn't anything as comprehensive that actually works like Origin. It having (as far as I know) the best APY is just icing on the cake. Highly recommend it!@sheel_mohnot Love this!!! Thank you for checking us out and using Origin :)@sheel_mohnot thanks for the product love! Especially appreciate the positive feedback from you as a fintech expert!Congrats team Origin! I was a heavy Mint user for years and sad when they closed it. Glad to finally find an alternative I'm happy to use and excited to see it keep improving so much.@benln Thank you!! Let us know what you think :)Hey guys, this looks really cool. I'm gonna give this a try.

Right now I use Kabata for net worth tracking, Monarch for spending tracking.

Can you tell me some of the key differences of Monarch and Kabata and Orgin?

I'm gonna try orgin because it looks really cool but would love to hear your pitch specifically on how its diff from those two products, which I assume will be major competitors.@thesamparr Hey Sam! Think of us as combining both assets and liabilities in one place. We calculate your net worth as a whole, and you can dive deeper into your transactions and categories for more detailed insights.

Our goal is to connect the dots at every level, helping you plan across different time frames—whether it’s building an emergency fund in the short term or planning for retirement.

Unlike most competitors who focus on just one area, Origin brings everything together, so you don’t have to bounce between different apps anymore.

Comments