Summary:

Freyr Battery acquires a 5GW module manufacturing facility in Texas from Trina Solar.

Total deal value of $340 million, consisting of $100 million in cash and 9.9% of common stock.

Plans to establish a 5GW cell production plant in addition to the module factory.

Leadership changes with Daniel Barcelo becoming CEO and Tom Einar Jensen heading Freyr Europe.

Acquisition aligns with US domestic manufacturing goals and benefits from the Inflation Reduction Act.

Freyr's Strategic Acquisition

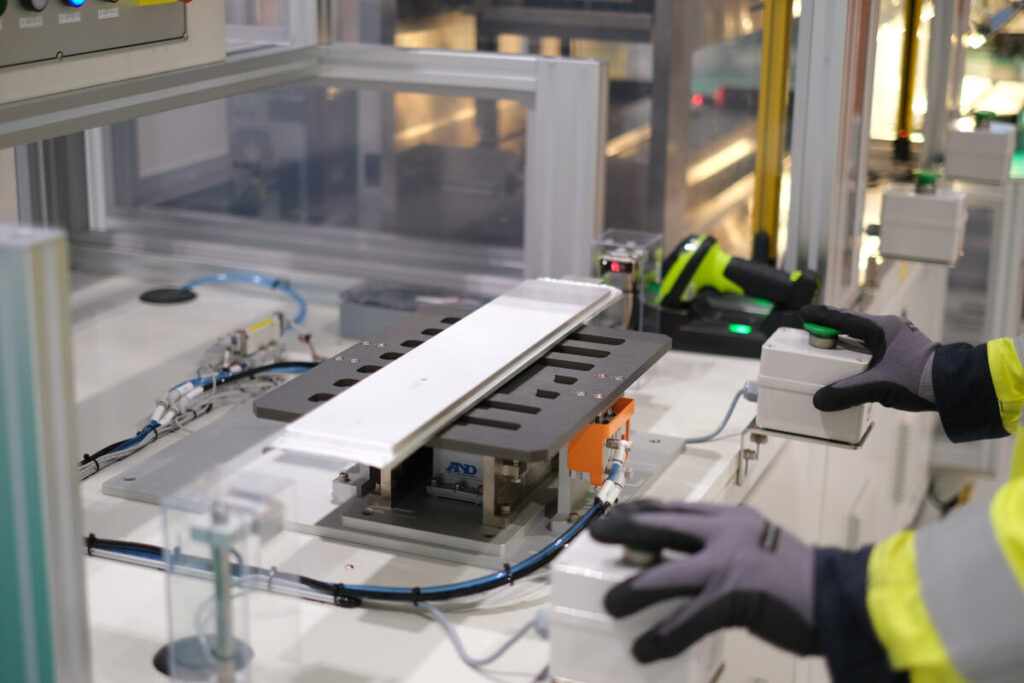

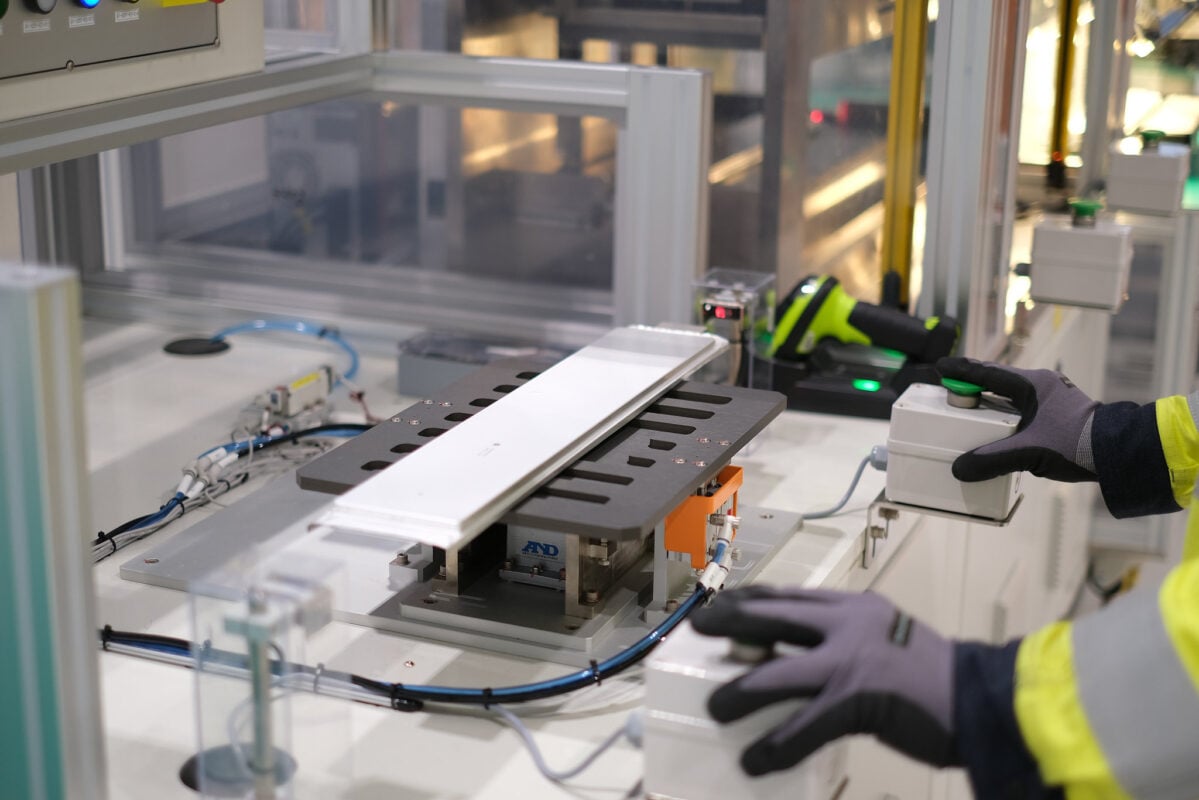

Battery manufacturer Freyr Battery has made a significant move by agreeing to acquire a 5GW module manufacturing facility in Texas from leading Chinese module manufacturer Trina Solar. This acquisition aligns with Freyr's vision to establish a vertically integrated solar manufacturing footprint in the US.

On the same day that Donald Trump won the US presidential race, promising measures to protect domestic manufacturing, Freyr announced its plans to enhance local production capabilities. The total consideration for the deal is $340 million, which includes $100 million in cash and 9.9% of Freyr's outstanding common stock.

Future Plans

Along with the acquisition, Freyr is also planning to build a 5GW cell production plant, with site selection already underway. The company aims to begin construction in the second quarter of 2025, targeting commercial production by the second half of 2026.

Leadership Changes

As part of the strategic shift, Freyr will undergo leadership changes: co-founder Tom Einar Jensen will step down from the board to become CEO of Freyr Europe, while current chairman Daniel Barcelo will take over as CEO.

Domestic Manufacturing

Barcelo emphasized the importance of this acquisition, stating that it positions Freyr as a leader in solar manufacturing in the US, which is crucial for energy transition and job creation. The company is already engaged in building a battery manufacturing plant in Georgia and is focused on expanding its presence in the renewable energy sector.

Market Context

Freyr's decision to acquire the Trina facility comes at a time when the US is witnessing a dramatic increase in solar manufacturing, driven by incentives under the Inflation Reduction Act (IRA). This legislation has significantly reduced production costs, making the US a more attractive location for renewable energy manufacturing.

Freyr's acquisition signifies a proactive approach to capitalize on these market changes and enhance its competitive edge in the solar industry.

Comments